This post considers a redacted copy of the Full Business Case that underpinned Havant Borough Council’s selection and ongoing implementation of the new generation of software support for its ‘Place’ services. These include the delivery of new IT systems covering Planning, Environmental Health, Enforcement and Licencing. The redacted Business Case was received in response to an FOI request.

Two months have now passed since we first highlighted significant shortcomings in the newly implemented Arcus Planning system. Since then, the council has introduced a workaround to address its earlier inability to process local land charges searches, and some of the prominent user interface issues have been addressed. Nonetheless, ongoing problems continue to affect how planning data is presented and processed.

Despite these relatively minor improvements, the absence of the full digital archive – covering more than 15 years of ‘decided’ planning applications available through the previous system – continues to undermine transparency and public trust. If the archive is not fully reinstated prior to the transfer of planning history to the new unitary authority’s system, there is a risk of permanent data loss. That would not only diminish public access to past decisions, but also weaken future transparency and certainty for residents and businesses.

With serious questions unanswered, Havant Civic Society submitted a Freedom of Information request for the Full Business Case, in the hope that it would help explain how and why we arrived at this point. Access to this documentation should also help the public understand the way in which the Arcus Software-as-a-Service (SaaS) solution was selected over its more dominant market competitor, idox Cloud, on the face of it, the more logical successor to the previous HBC legacy idox Acolaid system.

The Full Business Case (FBC) covers five ‘cases’:

Strategic Case – Why the project is needed. How it fits with the council’s goals and the benefits it should deliver.

Economic Case – Sets out the different options for meeting the need and compares their costs and benefits to arrive at the option which gives the best overall value for money, which is not necessarily the cheapest.

Commercial Case – How the chosen solution will be procured and delivered commercially: market analysis, supplier strategy, contractual arrangements, risk allocation, commercial viability.

Financial Case – The money. What it will cost, how it will be funded, and whether it fits within budgets.

Management Case – This sets out how the project will be managed. It covers plans for governance, timelines, risk management, monitoring, and how success will be measured.

The Strategic Case was clear, driven by two pressing factors: the looming expiry of the Capita outsourcing contract for IT services, and the imminent withdrawal of support for the legacy idox Acolaid planning system previously in use.

The Economic, Commercial and Financial cases should each contribute to the definition of validated options and a comparison of expected costs. To validate the options, the commercial case would need to set down the business requirements specification – what the system must do – and the data migration and mapping requirements – what data needs to move, from where, and how it must be handled. For completeness, in addition to the functional business requirements, the assessment should also take a look at the equally-important non-functional requirements, including capacity, scalability and usability, factors which would also contribute to the validation and assessment of the options and the pricing of the recommended solution.

The FBC recommendation was approved by the HBC Cabinet in December 2023 and the decision to sign a contract with Arcus Global was made by the Exec Head of Place in April 2024.

The Arcus solution was selected almost two years ago now, and so the Management Case is where this post will focus, concentrating on the project plan, the governance model, project and programme management, risk management, benefit realisation, monitoring and evaluation, and change management. The content of the redacted documents released under FOI leave many important questions unanswered.

The observations in this HCS post are based on the version of the FBC entitled ‘‘Place’ Service Software Procurement Full Business Case‘, Version 1, dated November 2023, redacted and issued in response to the FOI request.

Observations on the Management Case content

Caveat: The FBC documents released by HBC in response to the Freedom of Information Request by Havant Civic Society are notable for the manner in which they have been redacted. Personal details have been redacted and clearly marked in the appropriate way. However, the ICO might frown at the manner in which other material has been rather clumsily deleted or obscured. For example, document header texts and numbering which do not match the table of contents, images of Excel spreadsheets showing ‘zero divide’ (‘DIV/0!’) errors, significant dates left blank in tables and references to ‘Appendix x’, are all symptoms suggesting that the documents provided in the FOI response are either early draft versions or have been significantly edited. Redactions should be clearly shown.

The Key Risks

The risk assessment documented in the released FBC is presented as a screen grab of a spreadsheet rather than a document table, an approach which leaves sections of the detail missing from view. Despite this, it’s a predictable set of risks presented in a ranking which appears to have been modified since the ‘Original Assessment’. If the presentation shown below represents the priority order at the time of the FBC approval by the cabinet, then it appears that ‘Capita migration deadline’ (Risk ID – 1) had already been pronounced as ‘mitigated’ by the note in the final column to ‘Start as early as possible’ – see section below on ‘Schedule’.

A risk that we would have expected to have seen explicitly logged and ranked among the highest is ‘Failure of the supplier to deliver the agreed specification on time and within budget.’ This appears to expose a procedural flaw in the FBC since the Commercial Case section makes no reference to any documented business requirements specification for the systems – leaving unclear the ‘agreed specification’ the supplier was expected to deliver against. The nearest the FBC gets to a Business Requirements Statement is the rather woolly sentence:

“There is a desire to ensure that the new IT system (at the very least) ensures all the Planning and associated services systems remain together with a more flexible IT solution, maximising automation, digitation, data availability for customers and enabling greater mobile working to support steamlining [sic] processes and engagement with our customers.”

This risk is exacerbated by another line which appears to be missing from the risk assessment, one which will become obvious when we review the project team structure, below. That risk is that ‘There is a lack of HBC business analysis skills associated with the project‘, a risk we would expect to see ranked as ‘high’ impact and likelihood, unless mitigated by the assignment of a senior Planning Officer to the project on a full-time basis.

We are surprised to see no explicit mention of a contingency plan in the ‘Planned Mitigation Actions’ column.

The project schedule

At the time of the approval of the decision to appoint Arcus as the preferred supplier, the status reported by the Project Manager looked bullish. With the focus of his report biased towards the HBC estate ICT Infrastructure and Security portion of the Capita 5C Exit programme, the orange ‘Legacy systems to SaaS Migration’ line, despite being a critical component of the overall programme, simply shows an end date of December 2024.

The end December 2024 date is more cautiously presented in the FBC Key Milestones table, below, as the completion of ‘System Testing’ ready for six weeks of ‘Staff Training’ to begin in January 2025. We assume that the entries in the ambiguously headed ‘Complete by’ column refer to month ends.

Clearly, the project had been expected to hit the ground running in February 2024, with contracts signed and the Project Team in place by the end of January 2024 ready for Project Initiation to take place in February 2024. In reality, the approval to enter into contract negotiations with Arcus Global was given on 20 December 2023, but the approval to sign the contract wasn’t given until 3 April 2024. So unless the council took the decision to proceed ‘at risk’ with Arcus, the schedule had already slipped by at least two months before Project Initiation.

As another observation, the scheduling of a four week System Test period – including necessary rework – and a six week Staff Training period around the year-end 2024 Christmas and New Year period was either naïve or optimistic. Either way, the schedule was overly optimistic and, with a two month slippage built in from the start, it is no wonder that the project ended-up being right-to-left scheduled, up against the fixed termination date of the Capita idox Acolaid hosting contract.

If our suspicions are correct, then this project should probably have been flagged as ‘Red’ from the start.

Project Governance

The project structure depicted in the redacted version of the FBC is shown below.

The identity of the Programme Manager has been redacted, though the role would most appropriately rest with the HBC Head of Place. Any other executive name in that seat would provide a cause for concern.

The redactions in the Arcus Project Team suggest that named individuals had been assigned to the project by the publication of the FBC in November 2023 – six months ahead of contract signature, suggesting a possibility that the programme was already proceeding at risk.

To make sense of that project structure, we also need to look at the Roles and Responsibilities chart in the FBC:

The proposal to fill the project manager role with a fixed-term external sub-contractor raises a further risk, particularly since, as we noted under Key Risks, above, there was no dedicated HBC Planning Officer defined in the project organisation in the local role of Business Analyst. (This risk would have been lessened had the preferred solution been idox Cloud, since it might be assumed that idox, with a long relationship history with HBC and a dominant market position might have more mature in-house business experience than Arcus.)

To the author of this post, the most concerning aspect of the project structure appears to be one well-known to seasoned and battle-hardened IT professionals. The ‘data cleaning and transfer’ – data conversion and migration – roles appear to have been contracted out to external hires reporting at a level too low down the project structure. Experience informs us that for such a project, the data conversion and migration sub-project would probably account for in excess of 30% of the total project budget. While the seriousness of the risk is highlighted as ‘Risk ID – 2’ in the Key Risks chart (shown earlier), that risk would not simply have been mitigated by hiring external ‘data officers’ and positioning them at the wrong reporting level.

Observations on the Economic, Commercial and Financial Case content

It’s clearly too late to question how the vendor selection was managed, that horse has bolted and along with it, the HBC executives and elected administration who oversaw the decision.

The focus now needs to be on limiting the financial and commercial impacts of the decision and the project which it initiated. There is, however, a clear rationale for revisiting the FBC option costings and their derivation, given the possibility that the data and calculations underpinning Arcus’ designation as the ‘best value option’ may be flawed.

Comparison of the FBC Option Costings

While the redacted content of the FBC documents released with the FOI response can’t be relied upon for accuracy, the general picture presented by the table and the three cost summary charts below raise further questions.

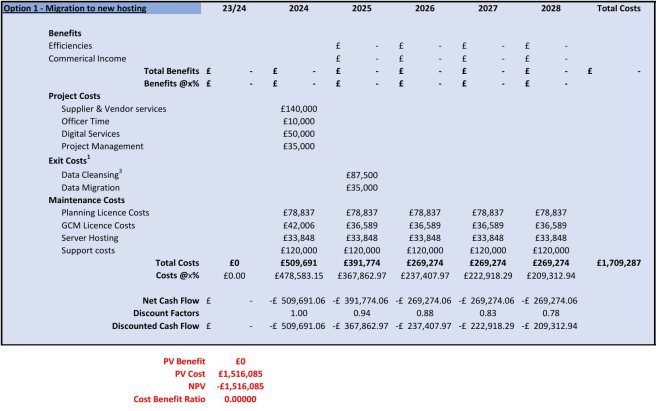

The redacted Full Business Case outlines three options, accompanied by a recommendation to Cabinet in November 2023. For those familiar with robust option appraisal, the comparative analysis below raises suspicion.

For those interested, click on each spreadsheet image to open at full size in separate browser windows.

To summarise the three options:

Option 1 – Continue with the same supplier, idox plc, deploying the idox Cloud Software-as-a -Service (SaaS) solution based on the company’s 2019 acquisition of Belfast based Tascomi.

Option 2 – Develop new IT solutions in-house at Havant Borough Council

Option 3 – Select Arcus Global as a new strategic IT partner, deploying the company’s SaaS offering based on the generic cloud-based Salesforce case management solution.

It’s a comparison easily whittled down to two runners since Option 2 appears little more than a ‘stalking horse’ which was unlikely ever to have generated a viable solution.

Option 1, idox Cloud, on the face of it, would appear to have been the logical front-runner given its clear data and process migration pathway from the company’s well known Acolaid solution. With both the replacing and the replaced solutions owned and managed by the same vendor, the mitigation of risks associated with data mapping and migration, internal and external stakeholder acceptance, and the challenge of mapping the business requirements should have been minimised.

Before even looking at the data mapping and business requirements specification – both of which should have formed part of the vendor evaluation exercise – Option 3 appears astonishingly cheap in comparison with Option 1.

While we can assume that the Option 1 data and function mapping would have resulted in the reuse of an established idox Cloud migration approach, without any evidence of an equivalent business process and data mapping for the Arcus/Salesforce solution, there’s no way of comparing the two main options.

The Option 3 costings appear to omit Data Cleansing and Data Migration whereas the Option 1 costings appears to include unexpectedly high ongoing costs for Server Hosting and Support Costs.

Despite being presented as comparable, the two main costed options appear not to be built on the same foundations.

The way forward

Havant is once again staring down a critical deadline: Local Government Reorganisation looms, with the borough likely to be absorbed into a greater Portsmouth unitary authority. The software failures we’re now grappling with are no accident – they’re the result of ten years’ of weak executive leadership, outdated staff practices, and a failure by elected members to provide meaningful scrutiny.

There is no value in assigning blame, and many of those responsible have already moved on. It is, however, a critical moment to reflect, learn, and take responsible action. That begins with a clear-eyed commitment not to repeat the mistakes of the past.

In the context of ongoing Local Government Reorganisation (LGR), it would be prudent to pause the pursuit of government housing targets until the new governance and planning support frameworks are fully established. We should look forward, informed by the lessons of past decisions, many of which have left lasting consequences. A temporary moratorium on the validation and determination of major new planning applications during the LGR process would be a measured and constructive step. This includes placing proposed developments at Campdown and Southleigh on hold until there is clarity, accountability, and a planning system that is stable, accountable, and fully operational.

There is now a fresh executive management team under new leadership. Last year’s elections cleared out many of the inactive representatives in the elected body and brought in several fresh and younger minds who are starting to challenge the mistakes of the past. With a strong core of technical, business and governance skills available in the professional citizen community, it’s time we all got around the table and worked together to provide Havant Borough’s residents and businesses with a lasting legacy.